Are you relying solely on financial statements for company valuation? You might be missing a critical piece of the puzzle. While balance sheets and income statements provide essential data, they often overlook the profound impact of top management on a company’s true worth.

This quote by Peter Seilern, «A company is always as good and only as good as its top management,» from his book Only the Best Will Do, isn’t just a catchy phrase; it’s a principle backed by extensive research in strategic leadership and qualitative valuation, and deeply rooted in practical business experience. It challenges us to look beyond the numbers and recognize that the quality of leadership is a critical determinant of a company’s success and valuation.

This article delves into why top management quality is a crucial, yet often undervalued, factor in accurate valuation. Academic studies, from the «Upper Echelons Theory» to research on the «CEO effect,» demonstrate that the characteristics, decisions, and ethical conduct of top management significantly influence a company’s trajectory and, ultimately, its value. Moving beyond the numbers and integrating qualitative analysis of leadership into your financial analysis is a must to reach a more comprehensive and insightful company valuation.

The Inherent Limitations of Traditional Quantitative Valuation

Traditional quantitative valuation methods, such as discounted cash flow (DCF) analysis, relative valuation using price-to-earnings (P/E) ratios and other multiples, are undeniably essential tools in the financial analyst’s toolkit. However, these methods are inherently limited by their reliance on historical financial data and projections, which are usually based on assumptions about future performance. These models often struggle to capture the dynamic and unpredictable nature of the business world, particularly the impact of strategic decisions, innovation, and the ability of management to navigate unforeseen challenges. They assume a level of rationality and predictability that doesn’t always exist, especially when considering the human element of leadership.

Furthermore, these models often fail to account for (the impact of) intangible assets, such as brand reputation, intellectual property, and, crucially, the quality of management. As Lev and Gu (2016) argue in The End of Accounting and the Path Forward for Investors and Managers, traditional accounting is becoming less relevant in today’s economy, and investors need to focus on intangible assets and qualitative factors, including management quality, to understand a company’s true value. This highlights the need to move beyond the numbers and incorporate a more holistic approach to valuation.

The Foundational «Upper Echelons Theory» and its Relevance to Valuation

The «Upper Echelons Theory,» initially proposed by Hambrick and Mason (1984) and later refined by Hambrick (2007), provides a crucial framework for understanding the impact of top management on organizational outcomes. This theory posits that organizational strategies and performance are a reflection of the cognitive bases, values, and experiences of top managers. It suggests that the strategic choices, risk appetite, and overall direction of a company are heavily influenced by the characteristics of its leadership team.

It’s not just about having a leader, but the specific characteristics of that leader that shape strategic choices and performance.

For valuation purposes, this means that understanding the who at the top is just as important as understanding the what the company does. A company led by a CEO with a strong track record of innovation and strategic thinking, as highlighted by Boeker (1997), might be valued higher than a similar company led by a more risk-averse or less experienced management team. This is because the market anticipates the potential for future growth and value creation driven by the visionary leader. Conversely, a company with a history of ethical lapses or poor strategic decisions at the top, as discussed by Treviño and Brown (2004), might be valued lower, reflecting the market’s concern about future risks and potential value destruction.

The «CEO Effect» and the Growing Importance of Leadership

The «CEO effect,» which refers to the impact of a CEO on company performance, has been the subject of extensive academic research. Studies, such as the one by Quigley and Hambrick (2015), have shown that the «CEO effect» has increased over time, suggesting that leadership is becoming an even more critical factor in organizational success. This is likely due to the increasing complexity and dynamism of the business environment, which requires leaders to be more adaptable, innovative, and strategic.

Additionally, a 2019 study by Sani Saidu titled «CEO characteristics and firm performance: focus on origin, education and ownership» explores the impact of CEO characteristics on firm performance. This study examines the impact of CEO characteristics, including ownership, education, and origin, on firm performance. The findings indicate that CEO education improves profitability, and stock performance improves when the CEO has prior experience with the firm before being appointed as the chief executive officer.

These studies contribute to the understanding of how CEO attributes can influence firm performance.

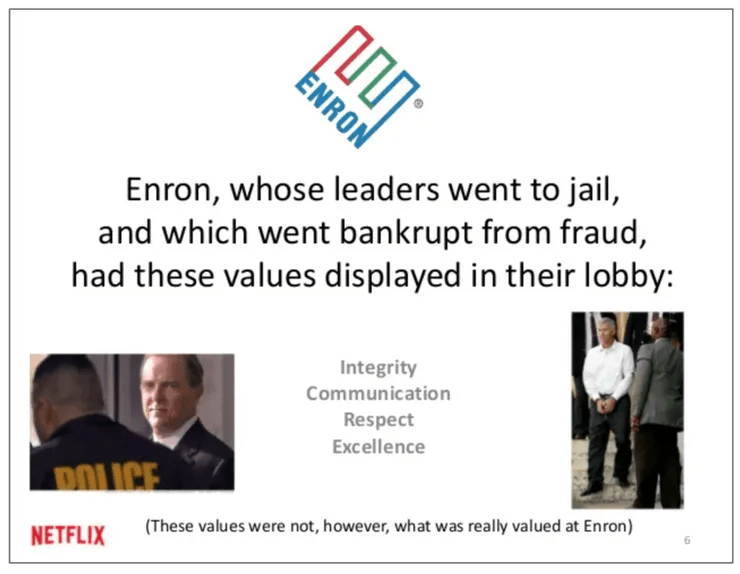

Moreover, the quality of leadership is inextricably linked to organizational culture and ethical conduct. As Treviño and Brown (2004) highlight, ethical behavior is not just a matter of individual character but is also shaped by organizational culture and leadership. Leaders set the tone for ethical conduct, and their values permeate the entire organization. This is further supported by Hofstede’s (2001) work on cultural dimensions, which shows that leadership styles and organizational cultures are influenced by national cultures.

The Role of Top Management Teams (TMTs) in Valuation

The «CEO effect» is not just about individual charisma or leadership style; it’s also about the CEO’s ability to build a strong team, foster a positive culture, and make sound strategic decisions.

The CEO is often the focal point of leadership analysis, but it’s crucial to recognize the importance of the entire top management team (TMT). As Finkelstein, Hambrick, and Cannella (2009) discuss in their comprehensive work on strategic leadership, the composition, processes, and dynamics of the TMT significantly impact strategic choices and performance. A diverse TMT, with members from different functional backgrounds and with varying perspectives, is more likely to foster innovation and make better decisions.

Research by Bantel and Jackson (1989) shows that the composition of the TMT affects the level of innovation in banking firms, highlighting the importance of diversity in the top team. This suggests that when evaluating a company, it’s essential to assess not only the CEO but also the entire TMT and their ability to work together effectively.

Qualitative Factors: A Deeper Dive into Leadership Assessment

The implications for valuation are profound. As Sloan (1996) demonstrated, accounting accruals can be manipulated, and investors should look beyond the numbers. This is where qualitative analysis becomes crucial. As Penman (2013) argues in Accounting for Value, financial statements are only a starting point; understanding the underlying business model and the quality of management is essential for accurate valuation. This is further supported by Kaplan and Norton’s (1992) work on the Balanced Scorecard, which emphasizes the importance of non-financial measures in driving long-term performance.

Assessing the quality of top management for valuation purposes requires a deep dive into qualitative factors that go beyond the numbers. These factors include:

- Track Record and Experience: What is the management team’s history of success in similar ventures or within the same industry? Have they consistently delivered on their promises? What specific skills and experiences do they bring to the table?

- Strategic Vision and Execution: Does the management team have a clear and compelling vision for the future of the company? Are they able to articulate a coherent strategy that aligns with the company’s goals? Are they able to effectively execute their strategy?

- Decision-Making Processes: How have they handled past challenges and opportunities? Are their decisions well-considered, data-driven, and effective? Do they have a clear process for making decisions?

- Team Building and Talent Management: Are they able to attract, retain, and motivate top talent? Do they foster a culture of collaboration, innovation, and continuous learning?

- Ethical Conduct and Corporate Governance: Do they operate with integrity and transparency? Do they prioritize the long-term interests of the company and its stakeholders? Do they have strong corporate governance practices in place?

- Adaptability and Resilience: How quickly and effectively do they respond to changing market conditions and competitive threats? Are they able to learn from their mistakes and adapt their strategies accordingly?

- Communication and Stakeholder Engagement: Are they able to communicate their vision and strategy effectively to employees, investors, and other stakeholders? Do they actively engage with their stakeholders?

- Organizational Culture: What kind of culture do they foster within the organization? Is it a culture of innovation, collaboration, and ethical behavior? As Schein (2010) highlights, leaders play a crucial role in shaping organizational culture.

«I try to invest in businesses that are so wonderful that an idiot can run them. Because sooner or later, one will.» Warren Buffett.

And when what Buffett predicts happens, the value will drop!

These qualitative factors are not easily captured by traditional valuation models, but they are essential for understanding a company’s true potential and risks.

Integrating Qualitative Analysis into the Valuation Process

Integrating qualitative analysis of top management into the valuation process requires a multi-faceted approach:

- Thorough Due Diligence: Conduct in-depth research on the management team, including their backgrounds, track records, and past performance. Utilize resources like LinkedIn, company websites, and industry publications.

- Interviews and Conversations: If possible, interview members of the management team to assess their vision, strategy, and decision-making processes. Ask open-ended questions that encourage them to share their perspectives and insights.

- Culture Assessment: Evaluate the company’s culture through employee surveys, online reviews, and other sources. Look for evidence of a positive and productive work environment.

- Stakeholder Feedback: Gather feedback from employees, customers, suppliers, and other stakeholders to gain a more comprehensive understanding of the management team’s effectiveness.

- Scenario Planning and Sensitivity Analysis: Consider different scenarios based on the potential impact of management decisions on the company’s future performance. Conduct sensitivity analysis to assess the impact of different leadership styles and decisions on the valuation.

- Use of Qualitative Frameworks: Utilize frameworks like the Balanced Scorecard to assess non-financial measures that are influenced by management quality.

- Comparative Analysis: Compare the management team to those of competitors and industry leaders. Identify best practices and areas for improvement.

By incorporating these qualitative factors into your valuation process, you can gain a more nuanced and accurate understanding of a company’s true worth.

Conclusion: The Indispensable Role of Leadership in Valuation

While quantitative analysis remains a cornerstone of valuation, it’s crucial to recognize its limitations. The quality of top management is a critical, yet often overlooked, factor that significantly influences a company’s long-term prospects and, therefore, its valuation. By moving beyond the numbers and integrating qualitative analysis of leadership into your valuation process, you can gain a more comprehensive and insightful understanding of a company’s true worth. The quote, «A company is always as good and only as good as its top management,» is a fundamental principle that should guide our approach to valuation.

It’s a call to action to look beyond the balance sheet and recognize the human element that drives success.

#leadership #management #valuation #qualitativeanalysis #business #investing #companyculture #strategy #success #UpperEchelonsTheory #StrategicLeadership #AccountingForValue #BalancedScorecard #EthicalLeadership

PS: Article researched and built with the assistance of AI

Descubre más desde Irrational Investors

Suscríbete y recibe las últimas entradas en tu correo electrónico.

[…] Only the Best Will Do, and without forgetting the qualitative factors we talked about previously in this article, investing in quality growth means selecting companies that meet strict criteria of financial and […]

Me gustaMe gusta