The concept of «quality growth» refers to a specific investment approach that focuses on identifying and maintaining a portfolio of high-quality companies with strong and sustainable long-term growth prospects. According to Peter Seilern’s book Only the Best Will Do, and without forgetting the qualitative factors we talked about previously in this article, investing in quality growth means selecting companies that meet strict criteria of financial and operational excellence.

Key Characteristics of Quality Growth Companies:

- High and Sustainable Return on Invested Capital (ROIC): These companies consistently deliver superior returns on their capital, reflecting their efficient use of resources.

- Sustainable Competitive Advantage: Quality growth companies operate in sectors where they maintain a durable competitive edge, enabling them to lead their markets over the long term.

- Strong Balance Sheets: Financial strength is a cornerstone, with low or no debt, ensuring resilience during economic downturns.

- Shareholder-Friendly Management: The management teams of these companies are committed to sustainable growth and aligned with the long-term interests of shareholders.

- Consistent Growth in Revenue and Earnings: These companies demonstrate reliable growth, even during challenging economic periods.

Before delving further, don’t these characteristics closely resemble other investment strategies? Is Quality Growth a kind of bridge? In this article, we reflect on how Value and Growth are not that far.

Benefits of the Quality Growth Approach:

- Superior Returns with Lower Risk: This strategy offers the potential for above-average returns while maintaining a lower risk profile compared to other approaches, due to the stability and predictability of the companies selected.

- Resilience in Bear Markets: Studies cited in the book show that during market downturns, quality growth companies tend to experience smaller losses than the broader market, allowing them to recover more quickly.

- Power of Compounding: Companies with high returns on capital that reinvest their profits at similar rates achieve exponential growth in their financial performance, ultimately reflected in their stock prices.

In summary, the quality growth investment strategy combines prudence and profitability by focusing on companies that are financially robust, operationally efficient, and capable of sustaining long-term growth. This approach seems ideal for investors seeking consistent returns while minimizing the risk of permanent capital loss.

Quality Growth Companies

Peter Seilern provides numerous examples of quality growth companies in Only the Best Will Do, each fitting specific criteria of his investment framework. Here are all the most relevant examples from the document:

- Mastercard

- Benefits from the secular shift from cash to electronic payments, which provides long-term growth opportunities. Its vast scale and network effects create significant barriers to entry

- Visa

- Another leader in electronic payments, benefiting from first-mover advantages and network effects similar to Mastercard

- Rightmove

- A dominant online real estate advertising platform with strong pricing power and market share. It consistently increases its fees without losing customers, reflecting its resilient business model

- Xylem

- A leader in water technology, demonstrating innovation in a fast-changing environment while maintaining industry leadership

- Graco

- Operates in fluid-handling systems and thrives in a high-turnover innovation environment

- Assa Abloy

- Specializes in doors and locks, showcasing rapid innovation to sustain leadership in its sector

- Automatic Data Processing (ADP)

- An example of a company that values innovation over a long cycle, maintaining a strong position in its market

- Dassault Systèmes

- Known for its software solutions with long innovation cycles, allowing it to maintain a competitive edge

- Novo Nordisk

- A Danish company specializing in insulin and diabetes products, which demonstrates consistent pricing power despite regulatory pressures

- Estée Lauder

- Leverages advanced data to strategically position its products, showcasing strong adaptability to changing market dynamics

- Moody’s

- Despite past reputational challenges, it has thrived in the corporate debt ratings market due to its enduring pricing power and increased demand for credit ratings

- L’Oréal

- Effectively adapted to the rise of e-commerce with strong governance and a digital strategy, maintaining leadership in the cosmetics market

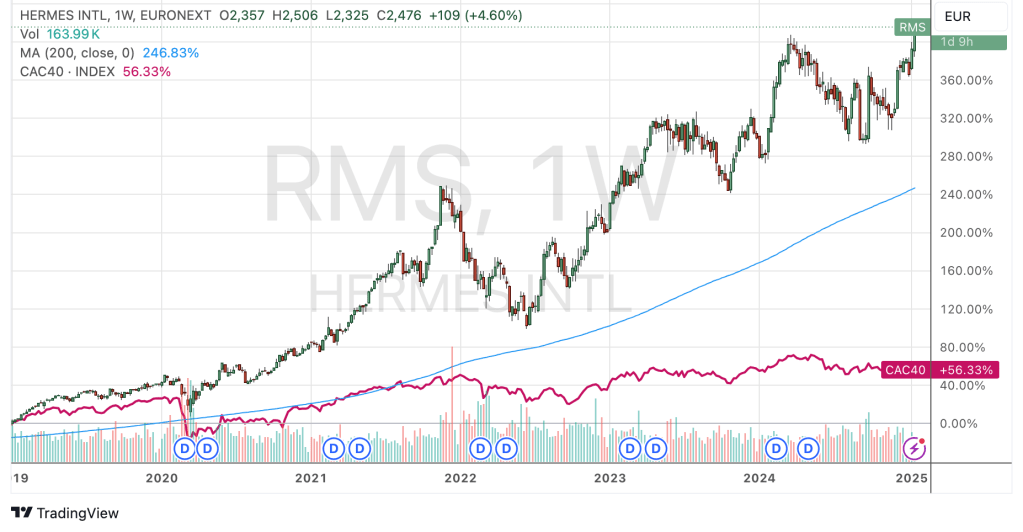

- Hermès

- Known for its luxury goods, the company has achieved consistent pricing power and growth despite global disinflationary trends.

- PepsiCo

- Highlighted for their pricing power and consistent market presence in their respective industries

- Inditex (parent company of Zara)

- Uses data analytics to guide product innovation and maintain its leadership in the fast fashion sector.

- West Pharmaceutical Services, Inc.:

- West Pharmaceutical Services is a leading manufacturer of packaging components and delivery systems for injectable drugs and healthcare products. The company specializes in solutions that enhance the safe and effective delivery of pharmaceutical and healthcare products.

- Booking Holdings Inc.:

- Formerly known as Priceline, Booking Holdings is a global leader in online travel and related services. The company operates several travel fare aggregators and travel fare metasearch engines, including Booking.com, Priceline.com, and Agoda.com.

- Fanuc Corporation:

- Fanuc is a Japanese multinational corporation specializing in robotics and automation. It is one of the largest manufacturers of industrial robots and CNC (computer numerical control) systems globally

- Straumann Holding AG:

- Straumann Holding AG, headquartered in Basel, Switzerland, is a global leader in dental implantology and restorative dentistry. The company specializes in the development, manufacture, and distribution of dental implants, instruments, biomaterials, CAD/CAM prosthetics, digital equipment, software, and clear aligners for applications in replacement, restorative, orthodontic, and preventive dentistry.

When the book was first published, they had shown resilience during economic downturns, and their business models allowed for reinvestment at high rates of return, making them ideal for a quality growth portfolio.

What has happened since then (2019)?

Let´s see if they have maintained the Quality Growth and the performance:

At first glance, it seems that at least for the stocks mentioned in the book, the performance has been more than satisfactory.

It is true that, as can be observed in the indices, the cycle has been highly positive in the period since the book’s publication, despite the COVID period. In fact, except for the performance of Estée Lauder, much of the relatively weaker performance comes from stocks listed on the Nasdaq, as they are not strictly among the most technological ones.

It should be noted that we have not conducted any analysis, neither of the situation in 2019 nor the present, and there could be fundamental reasons justifying the returns beyond those mentioned by Peter Seilern at the time. We have simply reflected the returns of the stocks featured in the book.

Peter Seilern is the founder and chairman of Seilern Investment Management, a boutique asset management firm specializing in equity investments focused on high-quality, sustainably growing companies. Among the funds offered, the most global is the Seilern World Growth Fund, which over the same period has achieved a return of 107% compared to 81% for the index (MSCI World).

Conclusion

Drawing on the principles outlined in Peter Seilern’s Only the Best Will Do, it seems evident that quality growth investing represents a refined and resilient approach to wealth creation. By focusing on companies with sustainable competitive advantages, robust financial health, and consistent growth trajectories, investors can achieve superior returns while mitigating risks inherent in volatile markets. Quality growth investing has shown (at least in the last 5 years) that true investing success lies in consistently backing the best.

It doesn’t seem like a bad approach, right?

#QualityGrowthInvesting #InvestmentStrategy #SustainableGrowth #FinancialExcellence #SmartInvesting #LongTermSuccess #WealthManagement #MarketLeadership #InvestmentPhilosophy #GrowthStocks

PS: Article researched with the assistance of AI

Descubre más desde Irrational Investors

Suscríbete y recibe las últimas entradas en tu correo electrónico.