In investing, do we play as fortune tellers or psychologists?

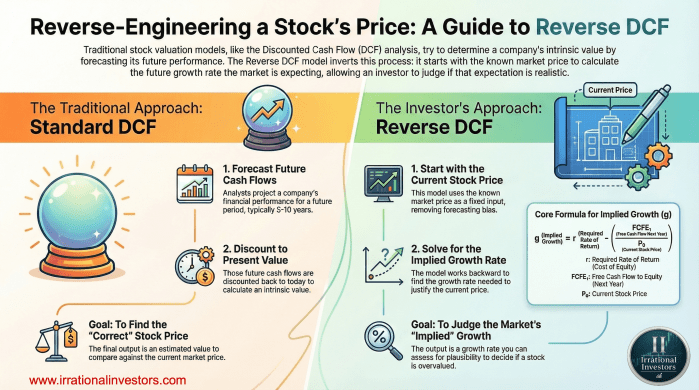

The traditional Discounted Free Cash Flow (DCF) method often pushes us to take out the crystal ball. We obsess over trying to forecast cash flows for 10 years (and into perpetuity) to find the «right value», an exercise that, whether we admit it or not, is usually full of biases and prediction errors.

The Reverse DCF (Reverse Discounted Cash Flow) proposes changing the focus. Instead of trying to guess the future, we act as market psychologists, inferring what the market «thinks.»

We start with the known current price and invert the equation to understand the growth expectations implicit in that price. The key question changes from «How much will this company grow?» to «Are the expectations that the market is paying today realistic?»

Less prediction and more deduction, that´s the game!

#ReverseDCF #Valuation #Investing #Finance #Strategy

Descubre más desde Irrational Investors

Suscríbete y recibe las últimas entradas en tu correo electrónico.