There are companies that the market decides have no future. Not because the numbers are bad or mediocre, but because the prevailing narrative is that «its moment has passed,» «it was a fad,» or «how wrong they were with that disastrous purchase,» etc. This is the story of CROCS right now.

From the outside, the diagnosis (more or less superficial) is as follows:

- An «ugly» product that became very fashionable during the pandemic.

- An expensive acquisition (HEYDUDE) at the worst possible time.

- A stock that has corrected sharply from its highs and whose trend is also «ugly.»

This is perfect material for many to discard without looking at a single number, neither historical nor projected. Let’s see if the story changes by digging a little deeper.

The HEYDUDE error, and whether there is still a cash register at CROCS

Let’s start with the basics, the «legacy» Crocs brand. The famous «Croslite» clog has not been a passing anecdote, like so many that occur in the world of fashion. It is, in fact, a very efficient product supported by three pillars:

- A single dominant mold.

- A proprietary material (patent) that is extremely cheap to produce.

- A customization ecosystem (Jibbitz) that is pure margin.

The result is that the CROCS brand, on its own, has a Gross margin of around 61–62% and an EBIT margin close to 25%, even when loaded with all global corporate expenses. That is not bad at all. On a consolidated level, with HEYDUDE diluting the net result, margins remain notably good, with Gross margin in the 58–59% range and adjusted operating margin around 20–21%.

Furthermore, and very importantly, in recent years, CROCS has generated approximately $500M in FCF in 2021 and 2022 and $800/900M annually starting in 2023, even with HEYDUDE in the midst of an adjustment phase. With a market capitalization of around $4.6–5.0B, we are talking about an FCF yield of 16–17%. This number already gives us some clues.

What really happened with HEYDUDE

In 2022, CROCS bought HEYDUDE for about $2.5B, primarily financing it with debt. The logic, on paper, made sense, adding a second lightweight footwear brand that was growing very fast in the USA and applying the strategy used with CROCS (inventory management discipline, global brand, more direct-to-consumer sales).

The reality has been quite different, because HEYDUDE depended almost entirely on the wholesale channel and, after years of hyper-growth, the channel became saturated. This led to forced liquidations and permanent discounts, translating into serious damage to brand perception. The lower brand value has forced a partial impairment of the acquisition’s working capital.

None of this has helped generate positive sentiment toward the company, and rightly so. However, the relevant question for the investor is not whether HEYDUDE was expensive (which it was, as events attest), but whether the problem today is unsolvable or manageable, that is, definitive or transitory.

Management has chosen to sacrifice revenue in exchange for trying to save the brand. To do this, they are reducing sell-in below sell-out, cleaning up the channel, sanitizing inventory, and reorganizing distribution channels. In the short term, this hurts results; in the long term, the company believes it is the only way to prevent HEYDUDE from becoming a black hole. But, in the meantime, CROCS keeps on generating lots of cash.

And what is CROCS doing with all that money?

Here is where the story does not quite square with the bearish argument. With FCF in the $800–900M zone, CROCS has done two things:

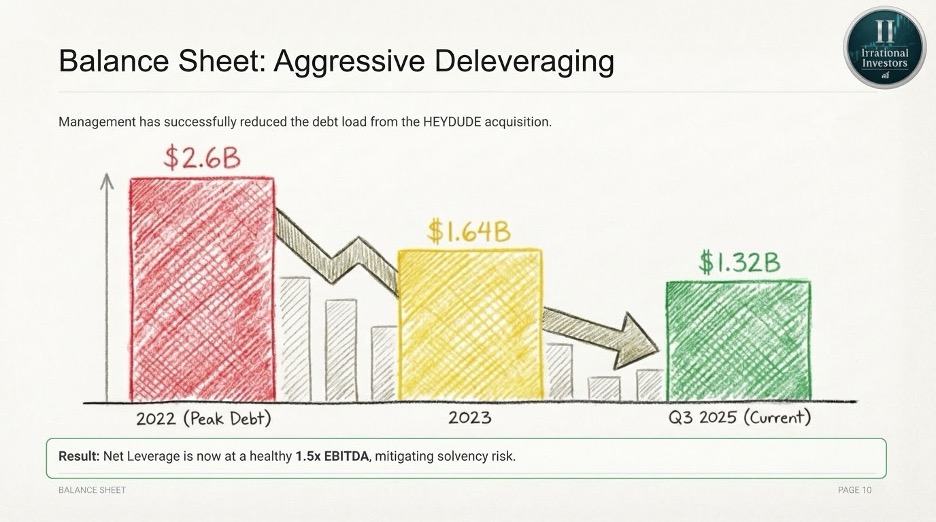

- Reduce debt. After the HEYDUDE purchase, total debt reached around $2.6B. Less than three years later, debt is around $1.3B, net debt/EBITDA is around 1.5x, and financial risk has decreased substantially.

- Aggressively repurchase shares. The management team has taken advantage of the stock price drop to repurchase shares at very low multiples. The buyback program has reduced the number of shares outstanding by around 16% in less than three years, and they still have almost $1B authorized to continue repurchasing, which is equivalent to approximately 20% of the current capitalization.

Beyond headlines and narratives, the relevant question is: what is CROCS worth?

If we look at comparables, the picture is as follows:

- CROCS trades at 7x Forward PE, 6–7x EV/EBITDA, and ~6–7x P/FCF.

- Skechers trades around 10x EV/EBITDA, with worse margins.

- Deckers and Nike play in another league of higher multiples.

If we carry out a Sum of the Parts (SOTP) valuing only the Crocs brand, loading it with all corporate costs and assuming HEYDUDE is worth zero, it would give a value of around $127 per share using a conservative multiple (9.5x EV/EBITDA).

If we carry out a valuation by normalized DCF, taking a sustainable FCF of $800M, a WACC of 10%, and perpetuity growth of 2%, we would arrive at a valuation of around $163 USD per share.

If we create a more optimistic scenario with FCF up to $1,060M in 2030, which assumes solid execution on the cost savings plan and some recovery of HEYDUDE, it would give a figure close to $193 per share.

At current prices, the implied perpetuity growth would be in negative territory, -4%, which implies that the market considers that the company not only will not grow, but that CROCS’ cash flows will decrease permanently, that HEYDUDE will continue to be a problem for years (if not forever), and that massive buybacks and deleveraging will not compensate for any of that. With a perpetuity growth of 2%, the price would be around $120.

With the stock around $89, and if we consider the previous valuations, CROCS would clearly be trading at a discount.

The company has been consistently delivering earnings surprises in recent quarters compared to what the market consensus expected, and yet the price has continued to fall. The divergence between price momentum and fundamental momentum is also an element to consider.

Permanent decline is certainly a possibility that must be contemplated, but what the numbers are saying for the moment is that:

- The core business is profitable,

- There was an expensive M&A error, but it has already been largely recognized on the balance sheet.

- The company has a much cleaner balance sheet than a couple of years ago in terms of leverage,

- The management team is using the cash with some sense and with a policy that takes the shareholders into account.

CROCS is not, by any means, «the next explosive growth story.» It is a company that has already passed through many stages, from a restructuring and strong growth to notable mistakes in expansion strategy, and now it trades almost as if it were going to disappear.

The reality told by the numbers so far is quite different from the current narrative, with margins that remain elevated, high brand recognition, an experienced management team, a healthier balance sheet, and favorable valuation multiples compared to competitors.

Anything can happen, and, certainly, it is not a company that will be free of shocks and volatility, but the divergence between fundamentals and price makes us ask if the market is not, once again, judging an asset by the most recent history, rather than by the numbers.

In short, the key question would be:

is CROCS a Deep Value stock or simply a Value Trap?

Judge for yourselves…

P.S: Article researched and developed with the assistance of AI

Disclaimer:

We wrote this article ourselves, and it reflects our own opinions. We did not receive compensation for it. We have no business relationship with any company whose stock is mentioned in this article.

The views contained in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell any of the securities mentioned, or as a solicitation of transactions or clients. Past performance is not indicative of future results. Investments in equities carry risks, including loss of principal. The analysis is based on data available as of December 5, 2025. The information contained herein is believed to be appropriate; however, under no circumstances should any person act solely based on the information provided. We do not recommend that anyone act on any investment information without first consulting an investment advisor regarding the suitability of such investments for their specific situation.

Irrational Investors and/or its affiliates may hold a position in the securities mentioned in this report and may make purchases or sales of such securities from time to time in the open market or otherwise. The analyst primarily responsible for this report may also hold a personal position in the subject securities.

Descubre más desde Irrational Investors

Suscríbete y recibe las últimas entradas en tu correo electrónico.