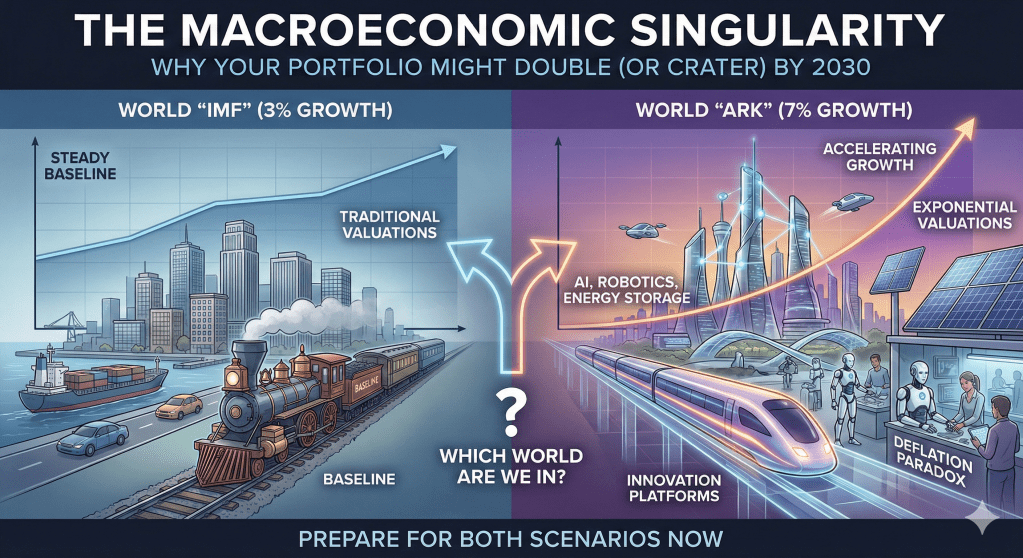

THE VALUATION RE-RATING – WHY YOUR PORTFOLIO MIGHT DOUBLE (OR CRATER) BY 2030

Imagine two parallel worlds. Identical in every way except one, economic growth rates are quite different. In World “IMF”, the global economy expands at 3% annually—the steady baseline we’ve known for decades. In World “ARK”, growth accelerates to 7%. By 2030, World ARK‘s economy is 22% larger. But here’s what really matters: in World ARK, equity valuations don’t just rise proportionally, they potentially double or triple through a mathematical phenomenon most portfolio managers haven’t yet grasped.

Which world are we actually in?

According to Cathie Wood, we’re entering World ARK. And most investors are catastrophically mispriced for it. But before you rush to rebalance, you need to understand both the extraordinary case for this transformation and the very real risks that could derail it entirely.

The Bull Case: Five Technologies Converging at Once

In December 2024, on Peter Diamandis’s Moonshots podcast, Wood presented what may be the one of the most consequential investment thesis of this decade, stating that AI isn’t just another technology wave, it is much more than that, it’s a catalyst accelerating four other innovation platforms simultaneously (AI, robotics, blockchain, energy storage, and genomics), all at once.

And the numbers behind the optimism aren’t pulled from thin air. They are based, according to Wood, mostly on AI training costs are declining 75% annually, inference costs have dropped over 99% in three years, robotics manufacturing is approaching automotive-scale production and solar plus battery storage is now cheaper than fossil fuels in most markets.

But here’s where it gets truly interesting for GDP calculations. Think about all the unpaid household work happening right now, cooking, cleaning, childcare, maintenance, etc. Enormous economic value, no question about that, bur, what is its contribution to measured GDP? Zero. Now imagine millions of households deploying humanoid robots by 2028. Suddenly, all that shadow labor gets formalized into the measured economy. If you scale that across 150 million households globally, you will add $720 billion to GDP, without anyone working more hours or consuming more resources.

And then there’s what she calls the deflation paradox. When AI reduces the cost of a cancer diagnostic from $5,000 to $50, that’s not economic contraction, it’s value creation. Given that, real growth of 7% could coincide with almost zero inflation, expanding corporate margins even if revenue growth moderates. A profit boom hiding inside subdued nominal numbers.

The Valuation Shock and Why This Changes Everything

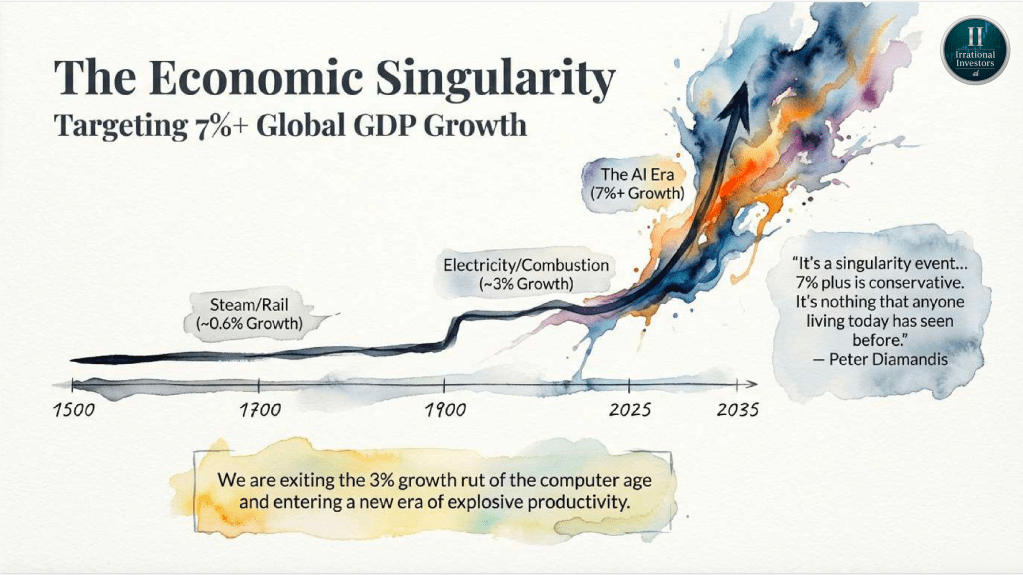

This is the part most investors are not paying enough attention, the shift from 3% to 7% GDP growth isn’t linear, it’s exponential in its impact on valuations.

Consider a well-positioned AI company. In a 3% world, its perpetual growth rate is 2%. In a 7% world, simply maintaining market position means growing at 6%. Using the Gordon Growth Model with a 10% required return:

- 3% World: Terminal value = 12.5x next year’s cash flow

- 7% World: Terminal value = 25x next year’s cash flow

The valuation doubles from this assumption change alone. And since terminal value typically represents 60-80% of total company value in a DCF model, this isn’t a marginal adjustment, it’s a fundamental re-rating of everything.

Now here’s the crux, if Wood is even partially right, say 5% sustained growth instead of 7%, most portfolios are significantly underweighted in technology leaders. The S&P 500’s forward P/E of 21x looks expensive in a 3% world. It looks reasonable at 5%. And it looks cheap at 7%.

But what if the thesis fails? Today’s tech valuations represent a spectacular bubble. The asymmetry is stark.

The Bear Case: Why 7% Might Be a Mirage

Extraordinary claims require extraordinary evidence, and history offers sobering lessons.

Every generation believes its technological revolution is unprecedented. Yet electricity (1890-1930) produced average U.S. GDP growth of 3.5%, automobiles peaked at 4.2% and the internet era averaged 3.1%. None of them sustained anything close to 7%.

Why? Adoption took longer than optimists projected, Productivity gains were offset by stagnation elsewhere and developed economies faced demographic headwinds, among others. Robert Gordon argues that AI might deliver a 20% productivity boost over a decade, but that translates to 1.8% additional annual growth, not 4%.

Then there’s one of AI’s main barriers, it’s phenomenally energy-intensive. If AI achieves the ubiquity Wood projects, global electricity demand could spike 20-30% by 2030. Building nuclear plants takes 10-15 years and solar faces rare earth constraints. The scenario where AI deployment outpaces energy availability isn’t hypothetical, it’s probable.

And we haven’t even touched regulatory backlash. If 40% of jobs face displacement, expect fierce political resistance. A single high-profile AI failure could trigger precautionary regulations that slow deployment by years. U.S.-China decoupling could bifurcate development entirely. And without touching the worries of the political “aristocracy” losing its power and protagonism…

Perhaps Wood isn’t wrong, but she’s early. Remember that autonomous vehicles were predicted mainstream by 2020, VR has been the «next platform» since 2014 and Blockchain remains niche after 15 years. If the acceleration peaks in 2035 instead of 2029, investors betting on imminent re-rating could endure a decade of underwhelming returns.

As Keynes warned, markets can remain irrational longer than you can remain solvent.

The Bottom Line

The 7% growth scenario isn’t certain, but it’s plausible enough to demand repositioning. Modest exposure to acceleration winners costs little if the thesis fails, but delivers extraordinary returns if it succeeds. Zero exposure to AI and robotics leaders? That’s catastrophic risk if Wood is even half right.

Three principles to keep in mind:

- Don’t bet everything on acceleration, but don’t bet nothing either.

- Favor Optionality, companies those win in both 3% and 7% worlds.

- Stay liquid and flexible. The evidence will accumulate faster than you think.

The macroeconomic singularity, if it arrives, won’t announce itself with trumpets. It will emerge gradually in benchmark scores, deployment data, productivity statistics, and earnings reports. By the time consensus recognizes it, valuations will have already adjusted.

In 2030, we’ll know whether Cathie Wood was visionary or premature. But waiting until 2030 to position your portfolio means arriving far too late. The time to prepare for both scenarios is now.

Disclaimer:

We wrote this article ourselves, and it reflects our own opinions. We did not receive compensation for it. We have no business relationship with any company whose stock is mentioned in this article.

The views contained in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell any of the securities mentioned, or as a solicitation of transactions or clients. Past performance is not indicative of future results. Investments in equities carry risks, including loss of principal. The analysis is based on data available as of December 5, 2025. The information contained herein is believed to be appropriate; however, under no circumstances should any person act solely based on the information provided. We do not recommend that anyone act on any investment information without first consulting an investment advisor regarding the suitability of such investments for their specific situation.

Irrational Investors and/or its affiliates may hold a position in the securities mentioned in this report and may make purchases or sales of such securities from time to time in the open market or otherwise. The analyst primarily responsible for this report may also hold a personal position in the subject securities.

Descubre más desde Irrational Investors

Suscríbete y recibe las últimas entradas en tu correo electrónico.